Register for Webinar on Zoom scheduled on every Wednesday at 04:00 PM PST

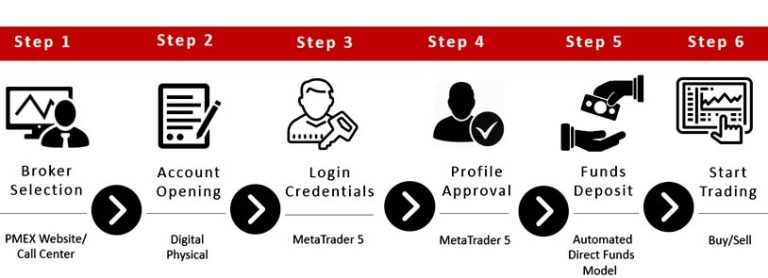

How to Trade Futures at PMEX

This is a step by step guide which explains the end to end process of starting futures trading at PMEX.

Step 1 – Selection of Broker

The selection of a broker should be based on the right combination of cost and services. It is important to verify that the selected broker is registered with SECP as a licensed futures broker. The verification can be done from the list of PMEX registered brokers available at PMEX website.

Any entity not listed on PMEX website is an unregistered broker and is operating in the Black/Grey Market. The Exchange is only responsible for brokers that are registered on its website. Dealing with Grey Market operators exposes a person to loss without any legal recourse. Investors should only deal with PMEX registered brokers which gives them legal recourse at the Exchange level and in turn with the SECP.

Step 2 – Account Opening

Once the customer selects PMEX registered broker, he gets the following two options to open an account:

1. Online Account Opening Process

Step# 1: Click here to find PMEX brokers where you can open your account online. Choose your desired broker and log on to the website of the selected PMEX broker and register by clicking the Digital Account Opening section. The customer will receive a User ID and Password through an email. After entering the User ID and Password, the customer is registered with PMEX broker.

Step# 2: The customer will log into the broker’s Dashboard, fill the Account Opening Form, agree to the Terms & Conditions, Risk Disclosure Document

and Terms and Conditions of KYC Application Form, attach supporting documents listed on the page and submit for broker’s verification.

Step# 3: After verification, the broker will send the customer’s details and documents to NCCPL.

Step# 4: NCCPL will send One Time Password vis SMS to the customer within 48 hours.

Step# 5: The customer will log into the broker’s dashboard and enter the OTP and press submit button.

Step# 6: Within 24 hours of submission of OPT, the customer will receive PMEX notification via e-mail with MT5 trading account credentials

(Trading Account ID and Password).

Step# 7: The customer will approve its account profile by logging in to PMEX Back Office Portal to initiate seamless trading.

2. Conventional Account Opening Process:

Step# 1: The customer manually fills out the Standardized Account Opening Form (SAOF) with correct, complete, and current information after carefully reading and understanding the terms and conditions along with the Risk Disclosure Document and Broker Commission Sheet.

Step# 2: The customer submits the duly filled SAOF and keeps a signed copy of it for future reference.

Step 3 – Login Credentials

Once an account is opened with the broker, PMEX will send the login credential of the MT5 Front End trading terminal and Back Office application to the customer through email.

Step 4 – Profile Approval

Once the customer receives the login credentials, he can log in to the Back Office application and approve his profile. Profile approval is mandatory before the customer starts trading.

Step 5 – Funds Deposit

To safeguard the interest of the investors, PMEX has introduced a unique Automated Direct Fund Mode (ADFM). Under this arrangement, the customers can deposit their margins directly with the Exchange, as well as, take withdrawals directly into their bank accounts without the involvement of broker(s). The DFM empowers the customers to get complete control over their funds at all times and restricts the role of the brokers primarily to servicing the existing customers and soliciting new businesses.

Brokers and their customers can transfer their funds to PMEX in the following ways:

a. Online Transactions

b. Over-The-Counter (OTC) Transactions

Step 6 – Start Trading

Once the customer deposits the funds, he will log onto the MT5 trading platform and start trading.

To strengthen the knowledge about futures trading at PMEX, you are advised to do the following:

Urdu

Urdu